Qualify for More.

Pay Less Tax.

Retain More Income.

Access the Small Business Financing Program for incorporated business owners.

Qualify using 100% of net business income, a 3-year average (when available) and 90% rental income.

This dramatically increases your borrowing power and your accountant will love it, too!

Takes 60 seconds to book and no cost to get your numbersWhy Business Owners Qualify for More.

100% Net Income

We use your corporation’s true net income - not just what you pay yourself personally.

3-Year Average

Strong income years boost your approval. We know business can fluctuate. Just like ours.

90% Rental Income

Maximize your buying power by using 90% of rental income across all properties.

Industry-leading add-Backs

Business expenses like depreciation, interest and amortization strengthen your qualifying income.

Lower Personal Taxes

Keep your corporate tax strategy intact while still qualifying for more.

Built for Business Owners

Designed specifically for incorporated business owners. We know your pain points.

How the Program Works.

Access Your Corporation’s Income

We review your true net business income. Not the small amount you pay yourself personally. This instantly increases qualifying power.

(24 hours)

Apply Lender Add & A 3-Year Average

We add back depreciation, interest, amortization, and average your strongest income years to maximize your usable income.

(5-7 days)

Get Approved With Banks

You qualify for significantly more while keeping your current tax strategy intact.We handle the paperwork and accountant coordination for you.

(30-60 days)

Real Results from Business Owners Like You.

“Switched from private B rate/Alt-lender to a credit union using 100% net business income and full lender add-backs.”

“Incorporated clients using the 3-year average and net-income method qualify for substantially higher amounts.”

“Most clients know exactly how much they qualify for within two days.”

Why This Program Works When Banks Say No.

We use your corporation’s true net income so you can qualify using what your business really earns.

Your strongest income years count

We use up to a 3-year average (when available) to capture your best years.

Industry-leading add-backs

Depreciation, interest and amortization strengthen your income instead of hurting it.

Built for incorporated business owners

This program is designed specifically for small business owners with fluctuating income

Our No-Risk Guarantee

✔ No-Cost Setup Guarantee

✔ Switch-Back Guarantee (30 Days)

✔ Hands-Off Promise — we deal directly with your lender

✔ Accountant Coordination Included

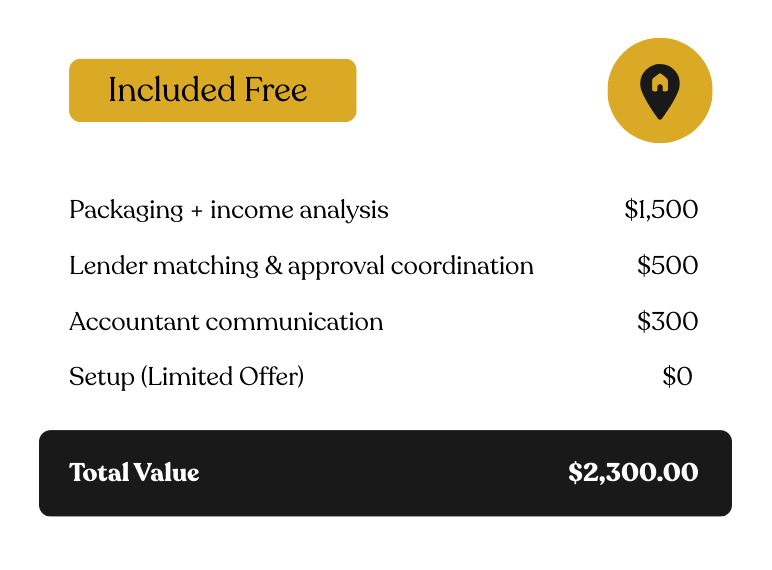

No cost. No risk. Just results.Included When You Apply This Month.

Zero Set Up Cost

We do all the work up front before you pay a penny. If you save, we earn. If you don’t, we don’t.

Accountant Reviewed and Approved.

We ensure your mortgage strategy aligns with your accountant’s tax plan.

12 Month Rate Monitoring

We notify you instantly when rates drop and create new savings opportunities.

What You Receive.

Most clients save between $1,500–$3,000/month. We show you your numbers before you commit.

What Others Say

Transparent & Professional

⭑

Best Competitive Rates

⭑

Seamless & Stress-Free

⭑

20 Years of Trust

⭑

Goes Above & Beyond

⭑

Knowledgeable & Friendly

⭑

First-Time Buyer Expert

⭑

Quick to Respond

⭑

Creative Solutions

⭑

Exceeded Expectations

⭑

Transparent & Professional ⭑ Best Competitive Rates ⭑ Seamless & Stress-Free ⭑ 20 Years of Trust ⭑ Goes Above & Beyond ⭑ Knowledgeable & Friendly ⭑ First-Time Buyer Expert ⭑ Quick to Respond ⭑ Creative Solutions ⭑ Exceeded Expectations ⭑

Industry Connections

⭑

Patient & Supportive

⭑

Great Customer Service

⭑

Reliable & Trustworthy

⭑

Low Rate in Tough Market

⭑

Record Time Approval

⭑

Personal Care & Service

⭑

Always There to Help

⭑

Treated Like Family

⭑

Professional Guidance

⭑

Industry Connections ⭑ Patient & Supportive ⭑ Great Customer Service ⭑ Reliable & Trustworthy ⭑ Low Rate in Tough Market ⭑ Record Time Approval ⭑ Personal Care & Service ⭑ Always There to Help ⭑ Treated Like Family ⭑ Professional Guidance ⭑

Market Expertise

⭑

10+ Years Experience

⭑

Never Steered Us Wrong

⭑

Hard Working Team

⭑

Challenging Deals Solved

⭑

Honest & Dedicated

⭑

Best Advice & Rates

⭑

Easy Process

⭑

Outstanding Results

⭑

Highly Recommend

⭑

Market Expertise ⭑ 10+ Years Experience ⭑ Never Steered Us Wrong ⭑ Hard Working Team ⭑ Challenging Deals Solved ⭑ Honest & Dedicated ⭑ Best Advice & Rates ⭑ Easy Process ⭑ Outstanding Results ⭑ Highly Recommend ⭑

FAQs

-

Banks only look at your personal T1 income. We use your corporation’s actual net income.

-

No — you keep your existing tax strategy. We qualify you without changing how much you pay yourself.

-

Most approvals take 30–60 days, depending on the lender.

-

Yes. We coordinate with your accountant directly so nothing changes on your end.

-

Yes. This program is specifically designed for incorporated owners and PRECs.

See how much you can save!

Take 60 seconds and see how much you can save.

✔ No-Cost Setup Guarantee

✔ Switch-Back Guarantee (30 Days)

✔ Hands-Off Promise — we deal directly with your lender

✔ Accountant Coordination Included

No cost. No risk. Just results.